If you’re staring down the barrel of an SAP Agent Performance Management (APM) implementation, cost is likely top of mind. For insurers and agencies, rolling out or modernizing APM isn’t just a technology decision—it’s a foundational investment in how producers are onboarded, compensated, governed, and retained.

You’re trying to balance a lot at once: producer adoption, accurate and timely commissions, regulatory compliance, clean data, and go-live timelines that don’t disrupt selling seasons or renewals. It’s a complex equation, which explains why, on average, organizations realize only 67 percent of the maximum financial benefits from major transformation initiatives. Most of that value loss doesn’t happen years later—it happens during implementation.

That’s especially true in insurance, where APM touches revenue, compliance, producer trust, and operational credibility all at once. The takeaway is clear: achieving ROI from SAP APM isn’t just about selecting the right software. It’s about how you implement it—and who actually does the work.

The Most Important Decision in an SAP APM Implementation

Insurance carriers and agencies often assume that once SAP APM is selected, the hardest decision is behind them. In reality, the most critical decision comes next:

Who should implement SAP APM for your distribution model?

There are two options:

- Use SAP’s professional services team

- Work with a specialized SAP insurance implementation partner

But beneath the surface, these two paths operate very differently—especially when you factor in insurance-specific complexity like producer hierarchies, state licensing, appointment rules, split commissions, chargebacks, retroactivity, and auditability.

To help you decide the best option for your organization, let’s go over how SAP APM implementations are actually delivered in the insurance market, why vendor services alone are rarely sufficient, and why going direct with a boutique insurance-focused partner is usually the most efficient and lowest-risk approach.

What an SAP APM Implementation Really Involves (in Insurance)

Insurance APM implementations are not generic HR or finance projects. They require deep, repeatable expertise across:

- Producer and agency hierarchies

- Appointment, licensing, and compliance alignment

- Complex commission logic and retroactivity

- Legacy commission data remediation

- Integration with policy admin, billing, CRM, and onboarding systems

- Parallel pay validation and audit support

- Producer-facing reporting and transparency

This isn’t theoretical work. It’s highly specialized, detail-driven execution that benefits enormously from having done the same types of insurance rollouts many times before.

Option 1: SAP Professional Services

Using SAP’s professional services team can feel like the safest choice. After all, SAP built the platform.

In practice, SAP’s professional services organization is intentionally lean. Their core focus is product development, roadmap execution, and platform support—not deep, industry-specific delivery at scale. As a result, SAP relies heavily on trusted implementation partners to execute most APM projects in the field.

That means even when you “choose SAP,” much of the hands-on configuration, data work, testing, and integration is often performed by partners behind the scenes.

The risk: you may be paying a vendor premium while still relying on external specialists—without direct access, transparency, or continuity.

What savvy insurance organizations do instead: they ask early whether the work will be delivered by partners, and if so, engage those specialists directly.

Option 2: Going Direct with a Boutique SAP Insurance Partner

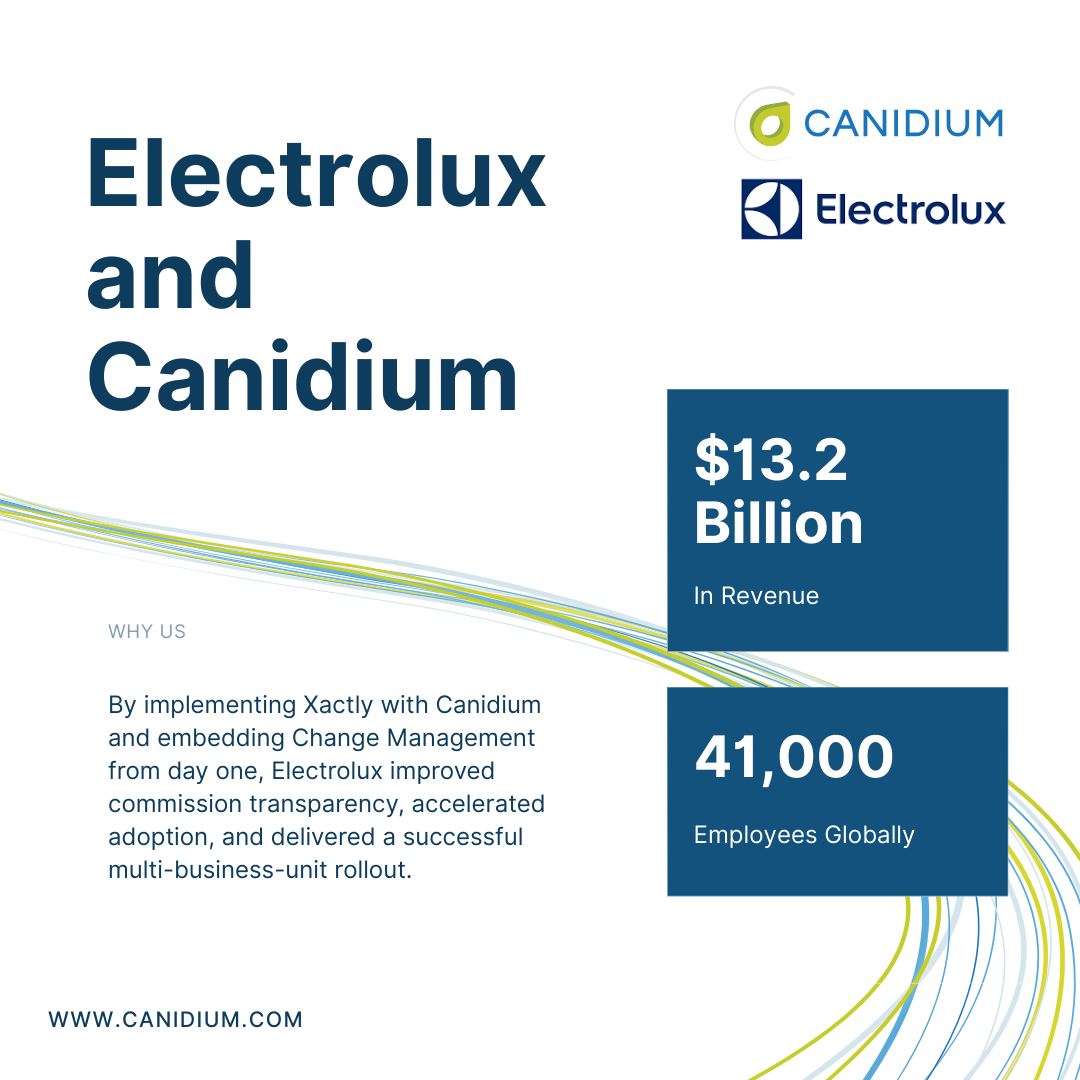

A boutique SAP insurance implementation partner like Canidium is the team that vendors rely on when APM projects get complex.

Going direct means:

- No extra markup layers

- Direct access to APM specialists

- Teams that understand insurance distribution—not just the software

- Proven delivery patterns for commissions, onboarding, and compliance

- Continuity from implementation into ongoing support

Unlike generalized consultancies, boutique partners specialize deeply. Canidium’s insurance teams work almost exclusively in SAP APM, commissions, onboarding, workflow, and analytics—across carriers, MGAs, and agencies with complex producer ecosystems.

That focus matters.

Insurance APM failures don’t come from missing features; they come from misaligned logic, dirty data, poor testing, and a lack of real-world insurance experience during design.

The Hidden Cost of “Indirect” SAP APM Delivery

When SAP APM implementations are routed indirectly—through layers of coordination rather than direct specialist delivery—customers often encounter:

1. Slower issue resolution

Insurance commission logic issues don’t resolve themselves. When multiple parties are involved, defects bounce between teams instead of being fixed decisively.

2. Loss of continuity

Design decisions made early in the project get lost by go-live. Producer disputes resurface. Knowledge walks out the door.

3. Higher long-term support costs

When the team that built your APM model isn’t the team supporting it, every enhancement, fix, or audit takes longer—and costs more.

Why Insurance Organizations Choose Canidium for SAP APM

Insurance carriers and agencies work with Canidium for three core reasons:

1. Insurance-first SAP APM expertise

Canidium’s teams don’t learn insurance on your project. They bring years of experience across producer compensation, onboarding, compliance, and distribution operations.

That translates to:

- Fewer design mistakes

- Faster parallel pay cycles

- Cleaner audits

- Higher producer trust at go-live

2. Collaborative, not transactional delivery

Canidium doesn’t just configure SAP APM and disappear. Teams co-build where appropriate, train internal admins, and leave behind documentation tailored to your compensation and distribution model.

3. Seamless transition to managed services

The same architects and consultants who implement your system can support it long-term—eliminating the costly “handoff cliff” that plagues many APM programs.

This continuity is one of the most effective ways to protect ROI over time.

Why Going Direct Works Better

The reality is simple: complex insurance SAP APM implementations almost always rely on boutique specialists. Going direct removes unnecessary layers and gives you:

- Transparency

- Faster decision-making

- Deep insurance expertise

- Lower total cost

- Long-term continuity

And because Canidium works closely with SAP’s product and services teams, you still benefit from vendor alignment—just without the friction.

A Safer, Smarter Path for Insurance SAP APM Success

In today’s market, insurance organizations can’t afford implementation missteps. Commissions must be accurate. Producers must trust the system. Regulators must be satisfied. And ROI must be defensible.

For SAP APM implementations in insurance, boutique partners deliver the strongest combination of:

- Specialist expertise

- Lower risk

- Faster time to value

- Long-term operational stability

Going direct isn’t just a cost decision. It’s a strategy to ensure your SAP APM investment actually delivers on its promise.

Want to learn how Canidium supports insurance SAP APM implementations end-to-end?