Across manufacturing and distribution, pricing teams are operating in a whiplash environment: input costs shift quickly, tariff regimes reconfigure trade lanes, and logistics costs rise or fall week-to-week. Producer prices are still moving: the U.S. Producer Price Index for final demand rose 0.9% in July 2025 (m/m) and is up 2.3% year-over-year through June, small numbers on paper that translate into constant list and net price maintenance in practice.

Meanwhile, tariff changes are directly lifting price levels. Independent analysis from Yale’s Budget Lab estimates 2025 tariffs add roughly 1.8% to consumer prices in the short run (assuming full pass-through), with the effective average U.S. tariff rate hitting multi-decade highs. For pricing leaders, that’s a structural uplift that has to be modeled, validated, and communicated to avoid potential pricing errors—only to be rendered potentially defunct should another rapid shift in the market disrupt these pricing strategies.

The situation is financially unsustainable, eliminating all opportunity for competitive pricing strategies. Companies need to address pricing disruptions now more than ever, and teams need greater agility to pinpoint and maintain margins with pricing optimization under these novel conditions.

The Pressure Points: Why Pricing Teams Feel the Squeeze

.png)

Workload Overload and Pricing Plan Disruption

In many categories, vendors are issuing more frequent and broader cost files, turning monthly maintenance into a near-continuous flow. Even modest PPI or tariff shifts can translate into thousands of SKUs needing review, repricing, and governance. (We’ve seen electronics distribution cost updates jump from semiannual events to monthly waves across tens of thousands of items, a level of churn manual tools simply can’t absorb.)

Margin Compression and Pricing Health

Middle-market manufacturers reported EBITDA margins of ~11.3% late last year while leverage drifted higher—so every missed pass-through or delayed pricing decision matters.

Competitive Pricing Strategies Under Uncertainty

Reshoring and nearshoring are real but uneven. Kearney’s 2025 Reshoring Index calls this year a “reality check,” with the index falling 311 points—intent is high, but supply chains are complex and savings aren’t automatic. That puts a premium on street-level market intelligence and subsequent reviews of pricing strategies, as well as landed-cost accuracy and overall pricing health.

Trends Changing Pricing Strategies (and How to Reshape Your Pricing Approach)

1: Raw-material and commodity swings

The World Bank expects commodity prices to fall ~12% in 2025, with metals down ~10%, but the path is jagged by policy and demand. In other words, the relief you feel today could give you whiplash tomorrow; so use scenario bands, not point estimates in your pricing strategies.

Action for leaders: Maintain rolling cost indexes and parametric price rules so you can cascade updates automatically (and reversibly) when metals, wood products, or chemicals move.

2: Supplier diversification and landed-cost variance

Production shifting from high-tariff or higher-cost regions to alternative countries changes duties, logistics, and lead times; sometimes lowering costs, sometimes just moving them. With reshoring momentum uneven, treat “country of origin” as a pricing attribute, not a footnote.

Action for leaders: Bring origin, duty, and freight into SKU-level cost objects; price on landed cost, not standard cost.

3: Tariffs and trade policy as a structural cost

Analyses suggest tariffs enacted this year alone will lift overall consumer price levels by ~1.8% in the short run. Don’t treat these as one-off surcharges; treat them like semi-permanent cost drivers that require governance, communication, and audit trails.

Action for leaders: Maintain a tariff playbook as a part of your pricing strategies: who qualifies for pass-through, timing by segment, and what exceptions require deal review.

4: Logistics Volatility

Ocean rates cooled from crisis peaks but remain jumpy by lane; the WCI’s week-to-week moves prove you need automation and dynamic pricing to support pricing practices that can manage surcharge updates and sunset rules.

Action for leaders: Connect freight indices to pre-set pricing rules; automate activation and removal of logistics surcharges with clear customer communications.

From Firefighting to Advantage: What Modern Pricing Capabilities Look Like

There's really no way around the fact that competitive companies need automated tools to help implement successful pricing strategies. The economy is too volatile for pricing departments to maintain optimal pricing solely with manual tools. Moreover, pricing software is a prerequisite for highly effective revenue generation strategies like real-time dynamic pricing. You need the infrastructure to design a closed-loop pricing process that can keep up with the market.

Here's how pricing tools facilitate dynamic pricing strategies and

Automated cost pass-throughs

When tariff codes or vendor files change, a rules-based pricing solution will cascade through list, matrix, and customer-specific pricing, with guardrails for floor/target margins. (Solutions like Pricefx support automated workflows, approvals, and bulk updates in minutes rather than days.)

Robust simulation and scenario planning

Before changes go live, simulate margin and volume impacts by segment, channel, and contract constraints. Tie simulations to live cost curves, not last quarter’s assumptions.

Competitiveness analytics

Blend market benchmarks and win/loss data to understand where you are too high, too low, or just right, and when to use structure (discount ladders) versus smart exceptions.

AI-assisted pricing operations

New “agent” capabilities are emerging that help teams spot leakage, flag exception abuse, and propose guardrails proactively. Pricefx, for example, announced up to 125 ready-made AI agents targeting margin protection and deal guidance, positioned as pragmatic co-pilots embedded in workflows.

Change governance and communication

Don’t rely on blanket increases in your pricing model; harmonize cadence (monthly/quarterly), articulate “why now” with data (tariffs, freight, input index), and pre-brief strategic accounts to minimize churn.

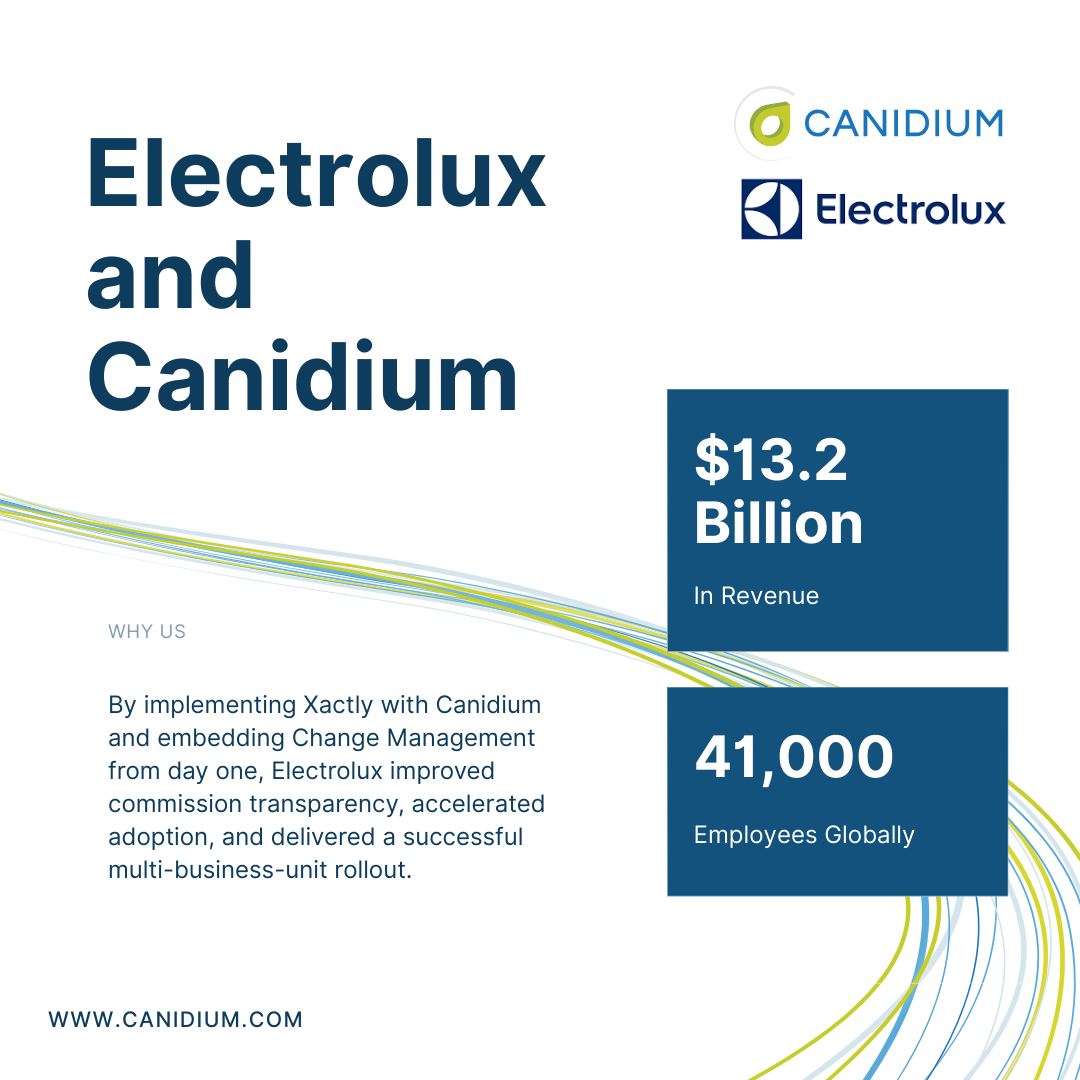

A Real-World Pattern We’re Seeing

In distribution, one of our clients was able to move from semiannual to monthly cost updates that touched tens of thousands of SKUs. Pre-automation, they were perpetually behind, absorbing costs and eroding margins. Post-implementation, they automated pass-through logic, layered in deal guardrails, and added exception governance. The result wasn’t just faster updates; it was fewer fire drills, a cleaner margin mix, and better customer conversations. They went live with their new pricing solution in February of 2025, and it's been a game-changer for them throughout the following months, allowing them to minimize the impacts of tariffs, inflation, supply-side issues, and overall economic volatility while maximizing their margins on each sale.

What Pricing Strategies and Market Trends to Watch

- Tariff resilience: Treat tariffs as lasting features of the cost landscape, not temporary storms. Align your pass-through and communication playbooks accordingly.

- Data granularity: Landed-cost precision (duty + freight + handling) is now table stakes for accurate pricing.

- AI, productively used: Focus on agentized, explainable tasks like leakage detection, exception triage, and quote guidance—over vague AI solutions

- Scenario agility: Build muscle memory for “up” and “down” cost scenarios; the World Bank baseline can shift, and you need levers ready for both directions.

Managing Market-Oriented Pricing Strategies on The Road Ahead

For pricing leaders, the future is both challenging and full of opportunity. As with many other operational areas, manual pricing approaches can't keep up with sleeker, automated solutions. Those who continue to rely on manual tools will find themselves overwhelmed by workload and margin erosion. On the other hand, those who embrace advanced pricing solutions will be able to transform volatility into strategic advantage. More and more, sticking to manual pricing tactics is becoming the equivalent of maintaining a paper filing system in the digital age.

As we near 2026, these conversations are more important than ever. The pace of change isn’t slowing, but with the right strategies, processes, and platforms, pricing leaders can not only keep up with economic pressures, but thrive under them.