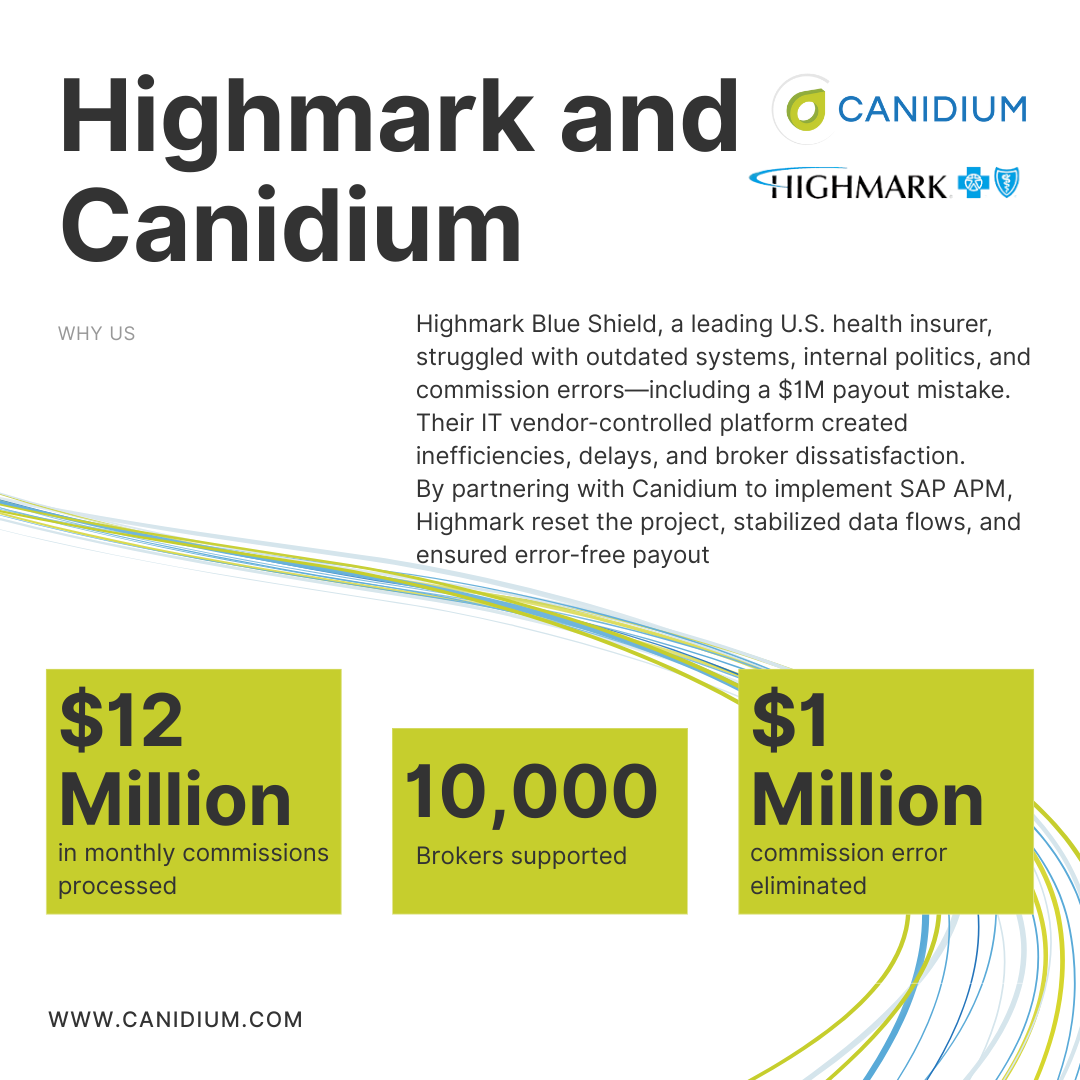

In health insurance, accuracy in broker commissions is more than operational—it’s strategic. For Highmark Blue Shield, outdated, error-prone systems and vendor conflicts created major risks. Their legacy platform, run by a for-profit IT vendor, suffered from poor documentation, staff turnover, and payment errors—including a high-profile $1 million mistake.

10,000 brokers and $12M in monthly commissions—with payouts managed on a broken, outdated system.

The situation was complicated by organizational politics: a nonprofit health insurance division relied on IT operations controlled by a for-profit subsidiary. Conflicting methodologies and competing interests caused delays, cost overruns, and growing frustration.

That’s when Highmark empowered Canidium to lead the transition to SAP Agent Performance Management (APM). Leveraging its proven methodology, Canidium reset the project, introduced collaborative testing, improved data handling, and documented every decision for accountability.

The transformation wasn’t just technical—it was cultural. By restoring transparency, aligning business and IT stakeholders, and focusing on data quality, Canidium delivered an error-free implementation that restored broker trust.

“After years of frustration and even a $1 million commission mistake, we needed a partner who could deliver stability and accuracy. Canidium gave us that confidence.”

The results were immediate. UAT finished ahead of schedule, the first commission payout was accurate, and broker complaints dropped. The system now reliably processes about $12 million in monthly commissions for 10,000 brokers. Highmark not only stabilized operations but became a vocal Canidium advocate, even co-presenting at the SAP SPM Summit in Dallas.

In an industry where commission errors can cost millions and undermine broker loyalty, Highmark’s story shows how Canidium delivers accuracy, transparency, and lasting trust.

FAQ: Highmark, Canidium, and SAP APM – A Commission Transformation

1. Who is Highmark and why did they need Canidium’s support?

Highmark Blue Shield is a major U.S. health insurer. Their outdated, on-premise commissions system—managed by an internal IT vendor—caused significant payment errors, including a $1M mistake. Politics, poor documentation, and staff turnover compounded risks, leading business sponsors to seek Canidium’s expertise.

2. What were the biggest challenges Highmark faced?

- Legacy system with poor documentation and high staff turnover.

- $1M commission error, eroding broker trust.

- Vendor conflicts between nonprofit health insurance and for-profit IT arms.

- Inconsistent, inaccurate data feeding commissions.

- A methodology that delayed decisions and ballooned costs.

3. What technical barriers existed?

- Outdated on-premise architecture.

- Poor data quality and misaligned formats.

- No clear system documentation or rule governance.

- Lack of scalability for growing commission volumes.

4. How did Canidium partner with Highmark?

- Took ownership with a project reset, using Canidium’s proven methodology.

- Introduced joint system integration testing (SIT) to align business, IT, and Canidium teams.

- Improved data handling by revamping formats to SAP standards.

- Delivered transparency and documentation, ensuring accountability for every decision.

5. What solutions were implemented and what was the impact?

- Error-free implementation with UAT completed ahead of schedule.

- First commission payout accurate, immediately reducing broker complaints.

- Consistently accurate payouts for 10,000 brokers.

- Scalable processing of $12M in monthly commissions.

- Restored trust between business and IT teams.

6. What measurable results did Highmark realize?

- Eliminated major payout errors.

- Reduced broker complaints with accurate, timely commissions.

- Stabilized $12M/month commission operations.

- Delivered project despite political and technical obstacles.

7. What technologies were used?

- SAP Agent Performance Management (APM).

- SAP Workflow and integration processes.

8. What role did leadership play?

Business sponsors pushed for a reset, giving Canidium the authority to lead the project and prioritize transparency, scalability, and accuracy over internal politics.

9. What feedback did Highmark provide about Canidium’s role?

Highmark praised Canidium’s ability to reset the project, align stakeholders, and deliver an error-free implementation. They became advocates, co-presenting with Canidium at the SAP SPM Summit.

10. Why should organizations with commission challenges choose Canidium?

- Proven expertise in fixing high-stakes commission systems.

- Ability to reset failing projects and deliver on time.

- Deep SAP APM knowledge and data integration skills.

- Trusted by enterprises managing billions in revenue and tens of thousands of brokers.