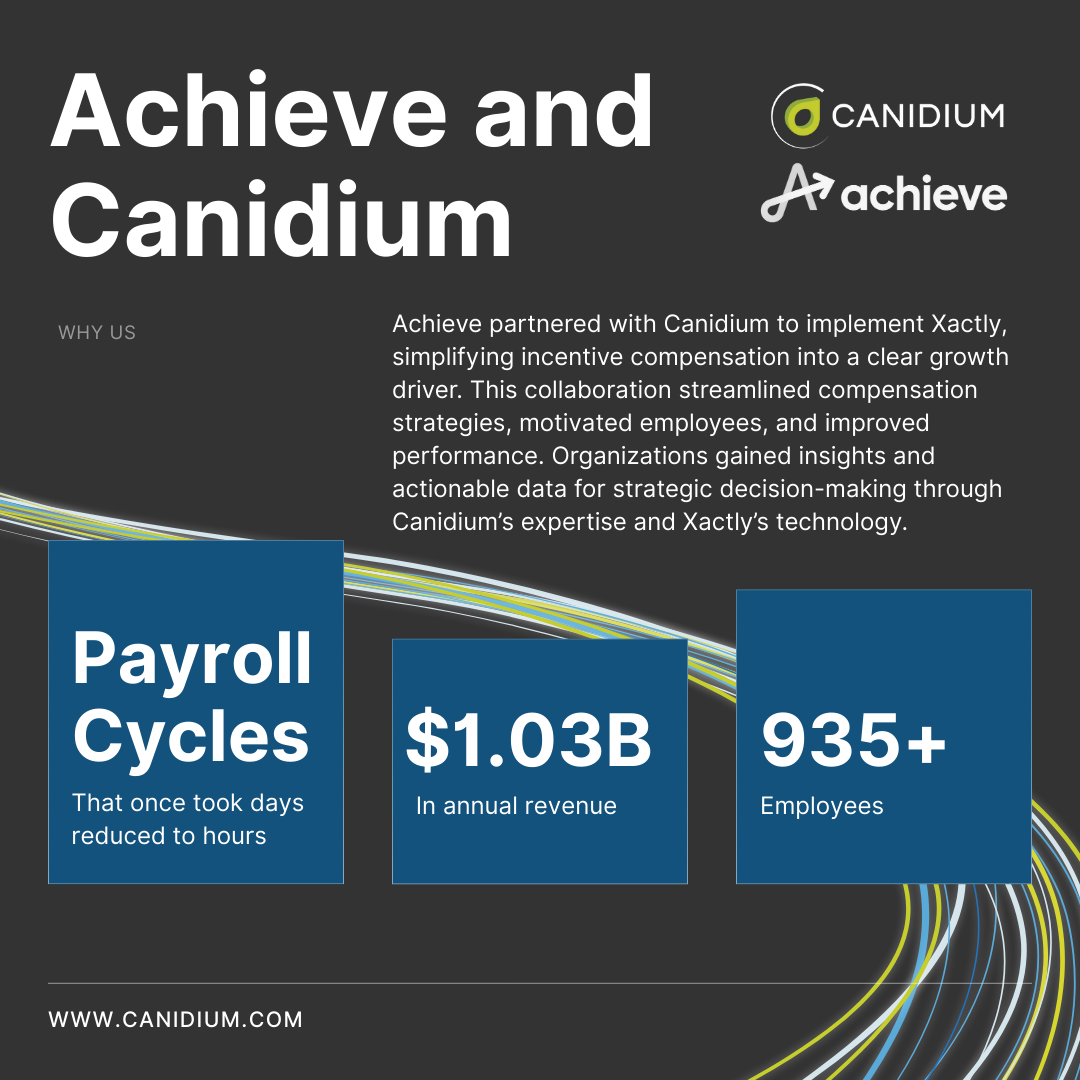

In the fast-moving world of financial services, speed and accuracy aren’t luxuries—they’re survival tools. For Achieve, a company with 935+ employees and generating $1.03 billion in annual revenue, the way commissions and payroll were processed had become a growing liability. Every month, the process demanded more time, more manual intervention, and more staff resources than the organization could afford. The team was wrestling with outdated workflows and fragmented systems that didn’t speak to one another, resulting in inefficiencies that rippled through finance, HR, and sales.

935+ employees and $1.03B in revenue—with payroll and commissions managed on outdated, manual processes.

The mandate from leadership was crystal clear: reduce overhead, streamline payroll and commissions, and build a model for long-term self-sustainability. The stakes were high—this wasn’t just about cutting costs. It was about reclaiming agility in a business where every delay in paying sales teams or closing payroll cycles could impact morale, trust, and ultimately, performance.

That’s when Achieve turned to Canidium and Xactly. The partnership was built on a shared vision: eliminate the bottlenecks, modernize the tools, and put processes in place that would allow Achieve to operate leaner without sacrificing accuracy or compliance. The solution wasn’t just a software deployment—it was a full operational overhaul. Automations replaced repetitive manual tasks. Centralized data sources meant payroll and commission teams no longer had to track down numbers from scattered spreadsheets. Transparent reporting gave leaders visibility they’d never had before.

“We needed a system that could scale without scaling our headcount—and we needed it fast.”

The transformation was immediately evident across the organization. Teams quickly experienced new efficiencies as manual workload dropped and critical information became accessible in real time. Where frustration and delays had dominated, there was now newfound clarity and momentum. Staff recognized the shift not only in process speed, but in a renewed sense of confidence and autonomy—empowered to direct their attention to higher-impact activities rather than being mired in administrative complexity.

Payroll cycles that once took days to close were completed in a fraction of the time—with fewer errors and less departmental back-and-forth.

Commission calculations, which affected hundreds of sales professionals, shifted from a monthly stress point to a streamlined, repeatable process. The new model didn’t just reduce the need for additional headcount—it freed existing staff to focus on higher-value work, driving strategic initiatives instead of chasing down numbers.

By the end of the transition, Achieve had delivered on its vision: operational costs dropped, inefficiencies were eliminated, and a sustainable system was in place to support future growth. What once felt like a constant scramble became a controlled, predictable rhythm—one that empowered teams, built confidence in the numbers, and created a foundation for the next phase of expansion.

In a market where many companies tolerate outdated processes simply because “that’s how it’s always been done,” Achieve’s story is proof that the right mix of modern technology, expert implementation, and strategic change management can unlock measurable results—and fast.

FAQ: Achieve, Canidium, and Xactly – A Payroll & Commissions Transformation

1. Who is Achieve and why did they need Canidium’s support?

Achieve is a financial services company with 935+ employees and $1.03B in annual revenue. Their commission environment was anchored to a 10+ year-old legacy platform, running on outdated architecture that relied heavily on batch jobs, FTP file transfers, and manual workflow interventions. To keep payroll and commissions running, multiple administrators dedicated 2–3 weeks each month to managing data loads, validating calculations, and handling disputes. The platform’s rigid data model, lack of APIs, and outdated reporting structure made it both error-prone and unsustainable, prompting the need for a complete modernization.

2. What were the biggest challenges with Achieve’s legacy system?

The legacy platform introduced both operational and technical constraints:

- Lengthy payout cycles: Payroll processing required multiple admins running sequential jobs that could fail without warning.

- High error rate: Incremental transaction data was prone to mismatches during ingestion, leading to disputes.

- Limited visibility: Stakeholders had no direct reporting or self-service access; results lived in flat files and spreadsheets.

- Poor controls: Weak governance created duplicate or conflicting rule sets.

- Single point of failure: A single administrator held unique knowledge of legacy scripts, creating organizational risk.

- Audit challenges: Lack of systemized audit trails and fragmented data stores made reconciliation difficult.

3. What technical barriers did Achieve face during this transformation?

- Data fragmentation: Transactional data resided in disparate systems (CRM, ERP, spreadsheets), requiring manual stitching.

- Aging infrastructure: The 10-year-old solution lacked scalability, APIs, and documentation, further compounded by turnover in technical staff.

- Manual process flow: Legacy workflows required direct editing of flat files and stored procedures, making them fragile and difficult to scale.

- Customization sprawl: Years of one-off changes left behind a patchwork of rules and scripts that were hard to maintain.

- Scalability issues: Adding new plans or mid-year changes risked breaking legacy logic.

4. How did Canidium partner with Achieve to solve these issues?

Canidium’s consultants designed a modernized architecture that addressed both data and process inefficiencies:

- Integration modernization: Replaced FTP-based transfers with REST APIs integrated through Xactly Connect, creating real-time data pipelines.

- Business continuity: Implemented new incentive plans mid-year without interrupting payroll by using parallel-run strategies.

- Data architecture: Centralized data sources and built repeatable integration patterns, improving throughput and reducing manual intervention.

- Agile delivery: Managed the transformation using Agile methodologies, ensuring flexibility for mid-cycle plan changes and business continuity.

5. What solutions did Canidium implement and what was the impact?

Executive Buy-In

- Brought executives into the process early, securing resources and reducing resistance.

Executive Visibility

- Delivered dashboards and reporting tools through Xactly Analytics, giving leadership real-time visibility into commissions data.

Streamlining Processes

- Built Custom Rule Management Interfaces: a UI overlay allowing a single admin to manage complex allocation rules spanning thousands of records.

Redesigning Workflows

- Replaced manual changes to 900+ plan units with automated Connect workflows validated against 10,000+ rules—ensuring stability without technical staff involvement.

Middleware & Salesforce Integration

- Implemented SAP CPQ Middleware patterns to move data seamlessly from Salesforce into Xactly for faster, more accurate reporting.

- Deployed BW (Business Warehouse) integration to support near real-time analytics.

Dispute Resolution

- Shortened resolution cycle from 3 weeks → 1 week with clear audit trails and automation.

Project Management

- Introduced Agile sprint cycles and governance checkpoints to ensure faster iteration and better alignment with business stakeholders.

6. What measurable results did Achieve realize?

- Payroll cycles reduced: From 2–3 weeks of manual work to a fraction of that time.

- Faster dispute resolution: From 3 weeks → 1 week.

- Process sustainability: Eliminated dependence on a single administrator.

- Efficiency gains: One administrator can now manage allocation rules previously requiring a team.

- Audit readiness: End-to-end visibility with logs, real-time dashboards, and data reconciliation.

7. What Xactly and other technologies were used in the project?

Xactly Technologies

- Xactly Incent – core incentive compensation management.

- Xactly Connect – for streamlined data integration and APIs.

- Xactly Analytics – for reporting, dashboards, and visibility.

Other Technologies

- Salesforce CRM – sales data capture and alignment.

- SAP CPQ Middleware – for data standardization and process design.

- BW (Business Warehouse) – for integrated analytics and reporting.

- JIRA & SharePoint – for project management, documentation, and governance.

8. What role did executive leadership play in this transformation?

- Actively participated in design reviews and sprint demos.

- Established governance structures to reduce approval delays.

- Championed change management, ensuring adoption beyond IT.

9. What feedback did Achieve provide about Canidium’s role?

“This was a complex exercise that was done without interruption to the legacy processes. Canidium deployed an experienced team who worked seamlessly with our technology and business teams. The end result was a high-quality solution delivered on time and within budget. We appreciate the partnership and look forward to future engagements.”

— Dureen Jayaram, Product Director, Enterprise Applications, Achieve

10. Why should organizations with legacy commission systems choose Canidium?

- Proven ability to retire legacy systems and implement modern incentive solutions.

- Expertise in Xactly, SAP, Salesforce, and connected ecosystems.

- Agile approach that reduces disruption and supports mid-year changes.

- Strong record of on-time, on-budget delivery for enterprise-scale clients.

- Focus on executive alignment, process visibility, and sustainability.